Medicare Part B and Part D

What are Medicare Part B and Part D?

Medicare Part B is your health insurance coverage. It covers two types of services, including medically necessary services to treat illnesses or conditions, such as doctor’s office visits, lab work, x-rays, and outpatient surgeries, and preventive services to keep you healthy, like cancer screenings and flu shots. Part B also covers medically necessary durable medical equipment such as wheelchairs and walkers to treat a disease or condition. Medicare Part D is prescription drug coverage. It helps pay for the medications your doctor prescribes.

How to calculate Medicare Part B premiums?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. The standard Part B premium amount in 2022 will be $170.10 (or higher depending on your income). However, some people who get Social Security benefits pay less than this amount ($130 on average). You'll pay the standard premium amount (or higher) if:

How to calculate Medicare Part D premiums?

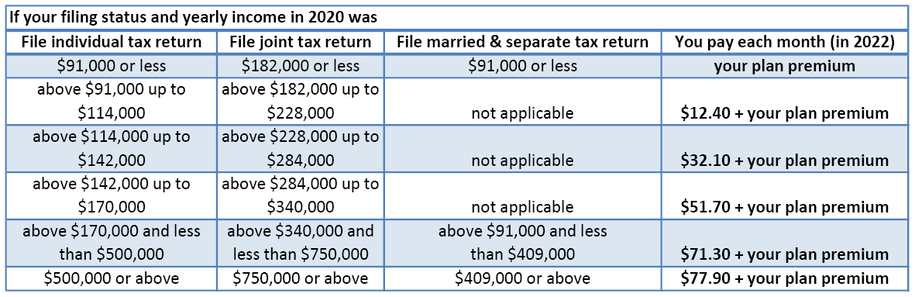

The Part D monthly premium varies by plan (higher-income consumers may pay more).The chart below shows your estimated prescription drug plan monthly premium based on your income as reported on your IRS tax return. If your income is above a certain limit, you'll pay an income-related monthly adjustment amount in addition to your plan premium.

Medicare Part B is your health insurance coverage. It covers two types of services, including medically necessary services to treat illnesses or conditions, such as doctor’s office visits, lab work, x-rays, and outpatient surgeries, and preventive services to keep you healthy, like cancer screenings and flu shots. Part B also covers medically necessary durable medical equipment such as wheelchairs and walkers to treat a disease or condition. Medicare Part D is prescription drug coverage. It helps pay for the medications your doctor prescribes.

How to calculate Medicare Part B premiums?

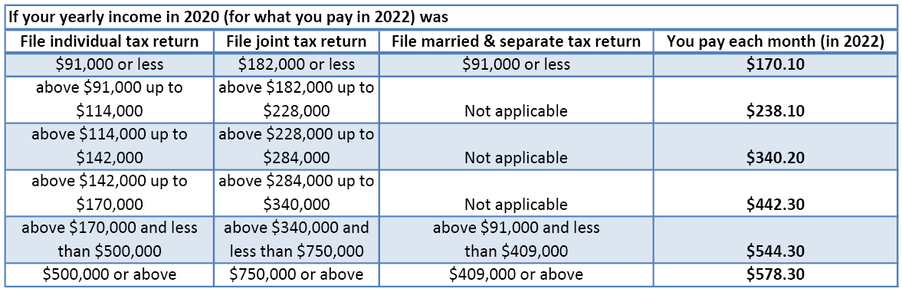

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. The standard Part B premium amount in 2022 will be $170.10 (or higher depending on your income). However, some people who get Social Security benefits pay less than this amount ($130 on average). You'll pay the standard premium amount (or higher) if:

- You enroll in Part B for the first time in 2022.

- You don't get Social Security benefits.

- You're directly billed for your Part B premiums (meaning they aren't taken out of your Social Security benefits).

- You have Medicare and Medicaid, and Medicaid pays your premiums. (Your state will pay the standard premium amount of $170.10.)

How to calculate Medicare Part D premiums?

The Part D monthly premium varies by plan (higher-income consumers may pay more).The chart below shows your estimated prescription drug plan monthly premium based on your income as reported on your IRS tax return. If your income is above a certain limit, you'll pay an income-related monthly adjustment amount in addition to your plan premium.