Home office expense deduction for a self-employed taxpayer

When you work out of your residence in a home office — or if you otherwise use part of your home in your business — you can deduct expenses related to the business use of your home as long as you use the space regularly and exclusively for business-related activity.

You can use the deduction for any type of home where you reside: a single family home, an apartment, a condo or a houseboat. You can use a studio, garage or barn space as your home office as long as the structure meets the “exclusive and regular use” requirements. Using a guest bedroom as both your office and a playroom for your children makes you ineligible.

There are two exceptions to the exclusivity rule, however. If you provide day care services for children, the elderly (age 65 or older) or handicapped individuals in that part of the house, you can still claim business deductions, as long as you have a license, certification or approval as a day care center under state law, according to the IRS. The other exception to the exclusive use test is if you use the office for storage of inventory or product samples you sell in your business.

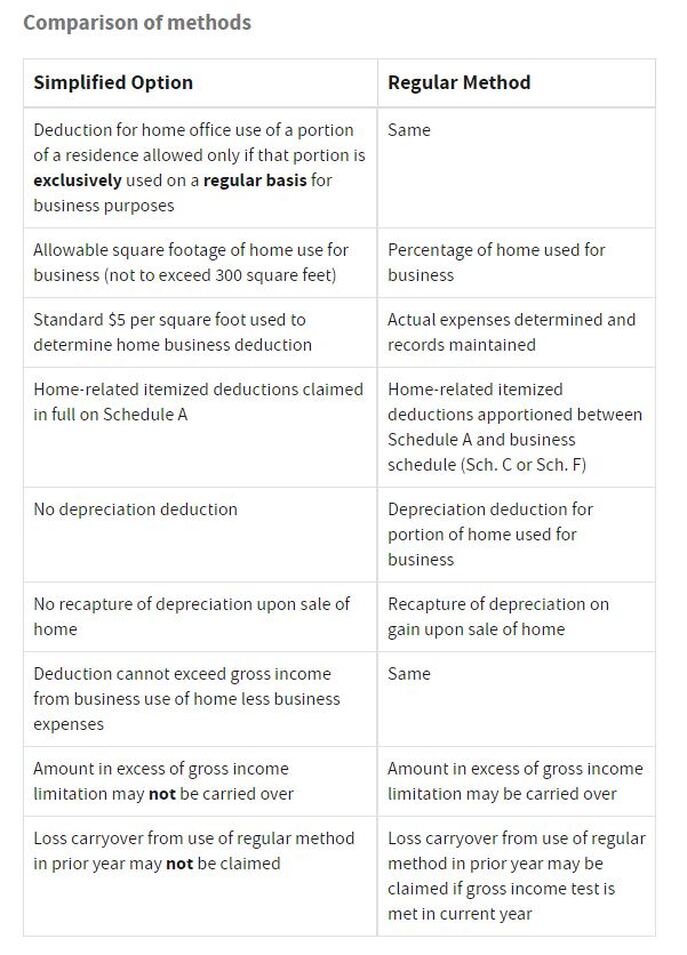

The actual vs. simplified method

After you’ve determined that your small business is eligible, you can either deduct actual expenses (get ready to do some math), or use the simplified deduction. Which method you should choose depends mainly on which nets you the bigger tax deduction.

If you deduct actual expenses, you can deduct direct expenses — such as painting or repairs solely in the home office — in full. Indirect expenses — mortgage interest, insurance, home utilities, real estate taxes, general home repairs — are deductible based on the percentage of your home used for business.

You can compute the business percentage of your home based on actual square feet, or you can use the “rooms method.” If all the rooms in your home are about the same size, you can simply divide the number of rooms used for business by the total number of rooms in your home (see IRS Publication 587 at www.irs.gov/pub/irs-pdf/p587.pdf). Go with the method that gives you the greater business percentage.

For example, let’s say you paid a total of $3,000 in mortgage interest, $1,000 in insurance premiums and $3,000 in utilities (all indirect expenses) plus $500 on a home office paint job (direct expense) in the 2016 tax year. Your home office is one room out of eight total similarly sized rooms (12.5%) and takes up 300 square feet in a 2,000-square-foot home (15%). In this case, using the actual square feet will give you a greater deduction of 15% on indirect expenses of your home.

You’d be eligible to claim a deduction of $1,050 in indirect expenses ($7,000 in expenses, multiplied by the 15% of space used in the home), plus $500 for the direct expense of painting the home office, for a total deduction of $1,550.

If you opt to take the simplified deduction, the IRS gives you a deduction of $5 per square foot of your home that is used for business, up to a maximum of 300 square feet, or $1,500. If your home office is over 300 square feet, it is limited to $1,500.

In this case, using the simplified method could make more sense since you’d only get $50 more in deductions by using actual expenses. If you go the actual expense route, you also need to figure in all the time it will take you to gather receipts and records.

Sales of homes with home office

When selling the home, the client has to pay a capital gains tax on the depreciation deduction taken in all past years. These recaptured deductions, called Unrecaptured Section 1250 Gain, are taxed at a 25% rate (unless the client’s income tax bracket is lower than 25%). However, if you are under simplified option, there is no recapture of depreciation upon sale of home.

Commuting expenses of taxpayers with office at home

Taxpayers who have an office at home can deduct the daily costs of travel between home and another work location in the same business, regardless of distance and regardless of whether the other location is regular or temporary.

Employees working from home

Unfortunately, W-2 employees are not eligible to claim home office deductions. Employees are also no longer able to deduct unreimbursed employee expenses as a part of miscellaneous itemized deductions. Beginning 1-1-18, the Tax Cuts and Jobs Act eliminated this deduction for taxpayers, so now, the best way to recover costs is to see if your employer has a company policy in place for employee expense reimbursement. If you meet certain criteria, the reimbursement may be tax-free income to you. See article for more details.

You can use the deduction for any type of home where you reside: a single family home, an apartment, a condo or a houseboat. You can use a studio, garage or barn space as your home office as long as the structure meets the “exclusive and regular use” requirements. Using a guest bedroom as both your office and a playroom for your children makes you ineligible.

There are two exceptions to the exclusivity rule, however. If you provide day care services for children, the elderly (age 65 or older) or handicapped individuals in that part of the house, you can still claim business deductions, as long as you have a license, certification or approval as a day care center under state law, according to the IRS. The other exception to the exclusive use test is if you use the office for storage of inventory or product samples you sell in your business.

The actual vs. simplified method

After you’ve determined that your small business is eligible, you can either deduct actual expenses (get ready to do some math), or use the simplified deduction. Which method you should choose depends mainly on which nets you the bigger tax deduction.

If you deduct actual expenses, you can deduct direct expenses — such as painting or repairs solely in the home office — in full. Indirect expenses — mortgage interest, insurance, home utilities, real estate taxes, general home repairs — are deductible based on the percentage of your home used for business.

You can compute the business percentage of your home based on actual square feet, or you can use the “rooms method.” If all the rooms in your home are about the same size, you can simply divide the number of rooms used for business by the total number of rooms in your home (see IRS Publication 587 at www.irs.gov/pub/irs-pdf/p587.pdf). Go with the method that gives you the greater business percentage.

For example, let’s say you paid a total of $3,000 in mortgage interest, $1,000 in insurance premiums and $3,000 in utilities (all indirect expenses) plus $500 on a home office paint job (direct expense) in the 2016 tax year. Your home office is one room out of eight total similarly sized rooms (12.5%) and takes up 300 square feet in a 2,000-square-foot home (15%). In this case, using the actual square feet will give you a greater deduction of 15% on indirect expenses of your home.

You’d be eligible to claim a deduction of $1,050 in indirect expenses ($7,000 in expenses, multiplied by the 15% of space used in the home), plus $500 for the direct expense of painting the home office, for a total deduction of $1,550.

If you opt to take the simplified deduction, the IRS gives you a deduction of $5 per square foot of your home that is used for business, up to a maximum of 300 square feet, or $1,500. If your home office is over 300 square feet, it is limited to $1,500.

In this case, using the simplified method could make more sense since you’d only get $50 more in deductions by using actual expenses. If you go the actual expense route, you also need to figure in all the time it will take you to gather receipts and records.

Sales of homes with home office

When selling the home, the client has to pay a capital gains tax on the depreciation deduction taken in all past years. These recaptured deductions, called Unrecaptured Section 1250 Gain, are taxed at a 25% rate (unless the client’s income tax bracket is lower than 25%). However, if you are under simplified option, there is no recapture of depreciation upon sale of home.

Commuting expenses of taxpayers with office at home

Taxpayers who have an office at home can deduct the daily costs of travel between home and another work location in the same business, regardless of distance and regardless of whether the other location is regular or temporary.

Employees working from home

Unfortunately, W-2 employees are not eligible to claim home office deductions. Employees are also no longer able to deduct unreimbursed employee expenses as a part of miscellaneous itemized deductions. Beginning 1-1-18, the Tax Cuts and Jobs Act eliminated this deduction for taxpayers, so now, the best way to recover costs is to see if your employer has a company policy in place for employee expense reimbursement. If you meet certain criteria, the reimbursement may be tax-free income to you. See article for more details.