Did You Know There Are 4 Tax Rates For Capital Gains?

Recent success stories:

We helped two clients by running some tax projections and advised them to delay the sale of real estate and stocks into the next year when their overall income was going to be less. Because the next year had lower income and therefore lower capital gains rates, it saved them approximately $26,000 and $63,000.

Capital gains taxes are divided into two groups depending on how long you’ve held the asset.

What are the capital gains tax rates?

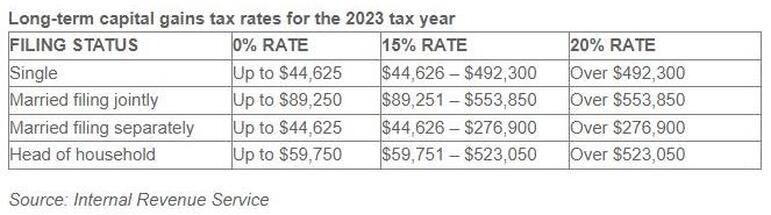

While the capital gains tax rates did not change under the Tax Cuts and Jobs Act of 2017, the income required to qualify for each bracket goes up each year with inflation. Here are the capital gains tax rates for 2023.

Source: Internal Revenue Service

We helped two clients by running some tax projections and advised them to delay the sale of real estate and stocks into the next year when their overall income was going to be less. Because the next year had lower income and therefore lower capital gains rates, it saved them approximately $26,000 and $63,000.

Capital gains taxes are divided into two groups depending on how long you’ve held the asset.

- Short-term capital gains tax is a tax applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains taxes are paid at the same rate as you’d pay on your ordinary income, such as wages from a job.

- Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate. In some cases, there can be an additional levy of 3.8%, so a maximum rate of 23.8%.

What are the capital gains tax rates?

While the capital gains tax rates did not change under the Tax Cuts and Jobs Act of 2017, the income required to qualify for each bracket goes up each year with inflation. Here are the capital gains tax rates for 2023.

Source: Internal Revenue Service

In 2023, individual filers won’t pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains if their income is $44,626 to $492,300. Above that income level, the rate climbs to 20 percent. In addition, those capital gains may be subject to the net investment income tax (NIIT), an additional levy of 3.8 percent if the taxpayer’s income is above certain amounts. The income thresholds depend on the filer’s status (individual, married filing jointly, etc.)

Meanwhile, for short-term capital gains, the tax brackets for ordinary income taxes apply. The 2022-2023 tax brackets are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Unlike the long-term capital gains tax rate, there is no 0 percent rate or 20 percent ceiling for short-term capital gains taxes.

Meanwhile, for short-term capital gains, the tax brackets for ordinary income taxes apply. The 2022-2023 tax brackets are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Unlike the long-term capital gains tax rate, there is no 0 percent rate or 20 percent ceiling for short-term capital gains taxes.